(Money Magazine)

Housing stocks, which not so long ago looked as likely to pay off as a $2 Powerball ticket, have become a hot commodity.

Anticipating the real estate recovery that surfaced in the fall — home prices in October were up 6.3% from a year earlier, and new-home construction reached a four-year high — housing-related stocks led the market in 2012.

Homebuilders (returning 77% through early December), the lumber industry (74%), and home-improvement stores (55%) were the top-performing industries in 2012, according to Morningstar. And the Dow Jones U.S. Home Construction ETF traded in December at a lofty 27 times projected earnings — nearly double the figure for the S&P 500.

These numbers may make a housing investment look expensive, but it’s not too late for you to profit from the revival. The 2012 surge in stock prices was merely a snap back from the worst real estate correction on record, says Michael Magiera, manager of real estate analysis for investment firm Manning & Napier. “Keep that performance in the context of the long cyclical recovery we’re going to have,” he says.

Related: Million-dollar foreclosures

Of course, various factors could delay progress: elimination of the mortgage interest tax deduction, for example, or an unexpected surge in foreclosures. Still, economists predict a continued upswing.

Moody’s housing economist Celia Chen, for one, forecasts above-average growth in construction, prices, and home sales through 2014. “After that,” she says, “growth will still be healthy.”

That’s good news for the slice of your portfolio invested in real estate.

Over the past 20 years, home-related stocks have roughly tracked new construction, itself perhaps the best indicator of the housing market’s health. Plus, growth over a cycle can justify the high price/earnings ratios that housing stocks might have initially; future earnings and price appreciation can make those formerly costly-looking stocks seem cheap in hindsight.

Related: Housing to drive economic growth

To maximize your profit, though, you have to look beyond what real estate fund managers judge to be the most expensive parts of the industry: homebuilders and real estate investment trusts that own apartment buildings.

So here are three creative strategies for investing in the boom, along with stock and fund picks for each.

STRATEGY NO.1: Buy the suppliers, not the homebuilders

The numbers support more growth in the housing market. October’s annualized figure of 894,000 housing starts — up 42% from a year earlier — was still well below the industry’s 50-year average of 1.5 million. Existing-home prices will rise 3.3% a year through 2017, forecasts Fiserv Case-Shiller.

“All signs are flashing green,” says Jeff Kolitch, manager of the Baron Real Estate Fund.

Problem is, the most obvious beneficiaries of this trend — homebuilders — are the costliest stocks in this arena, say Kolitch and other fund managers. “The risk-reward proposition,” he says, “is more interesting elsewhere.”

One such area: companies selling to homebuilders. The suppliers may have similarly high P/Es, but their prospects for earnings growth are better, partly because their profits come as a delayed reaction to homebuilder activity.

The picks: The division of Weyerhaeuser Co. (WY, Fortune 500) supplying lumber and plywood board to builders — a money loser in the bust — has begun to drive earnings, thanks to the minimal investment needed to boost production.

The company’s profits, up 48% in 2012, are forecast by analysts to jump 88% in 2013. (Weyerhaeuser converted to a real estate investment trust in 2010, giving it favorable tax treatment in return for paying out most of its earnings as a dividend, now 2.5%.) While the company’s 30 P/E is high, a return to 2004 earnings levels — not a stretch — would translate into a P/E of only 12, says Ryan Dobratz, co-manager of Third Avenue Real Estate Value, where Weyerhaeuser is a top 10 holding.

Related: $214,000 real estate bet a big risk for couple

A broader way to play the growing demand for timber is via a low-cost exchange-traded fund: iShares S&P Global Timber & Forestry Index (WOOD), which has Weyerhaeuser, Rayonier, and Plum Creek Timber as its top holdings. The average-size home uses about $25,000 worth of lumber, according to the National Association of Home Builders, and construction activity powers the ETF’s performance. In December, the fund was up 19% for the year.

STRATEGY NO. 2: Get in on the renovation resurgence

Each percentage point of appreciation in housing prices translates to an additional $190 billion in home equity — or about $2,500 per household — says the National Association of Realtors. That uptick makes owners feel more confident about spending money to fix up their houses.

U.S. remodeling spending, which by July 2010 had fallen 37% from its 2007 peak, is on the rise again, up 12% year over year in September. The NAHB predicts a 2013 rise of 3.4%.

Companies tied to renovation didn’t go unnoticed in 2012; like the high-performing home-improvement retailers, furniture companies racked up big returns — 29% through early December. Still, many renovation stocks are expected to grow earnings at double the rate of the average large stock.

The picks: Lowe’s (LOW, Fortune 500), operator of 1,745 home-improvement stores around the country, is one of the biggest beneficiaries of this upsurge in activity, says Dobratz; recently reported sales to professional contractors were particularly strong.

The company does more business than larger rival Home Depot (HD, Fortune 500) in big-ticket items like cabinets and appliances, which are snapping back in the recovery.

While its P/E ratio of 20.2, based on expected earnings, was higher than the Standard & Poor’s 500’s 14 in December, earnings at Lowe’s are expected to grow faster — 20% this year, compared with 11% for the S&P. MONEY recommended Home Depot in October, but Dobratz and other managers say Lowe’s, which had surprisingly good third-quarter results, is the better choice.

Or you can buy a basket of home-improvement stocks via S&P Homebuilders ETF (XHB). Don’t be fooled by the name: The ETF has 45% of its assets in home furnishings and other remodeling-related companies (and only 25% in homebuilders). Lowe’s is its top holding; Whirlpool, Home Depot, and Pier 1 Imports are among its top 10.

STRATEGY NO. 3: Profit from people on the move again

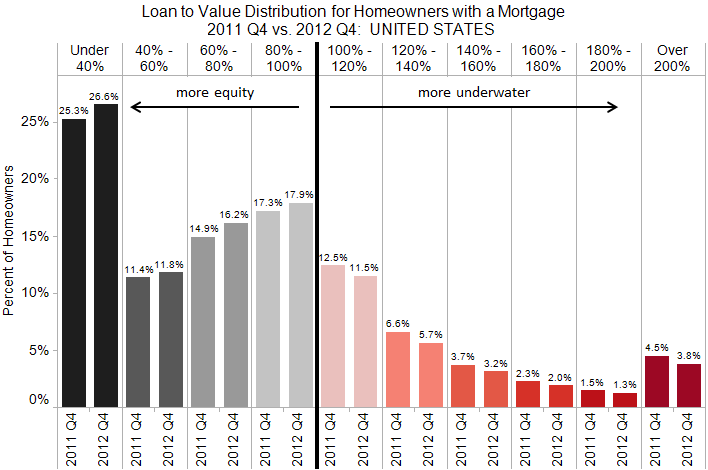

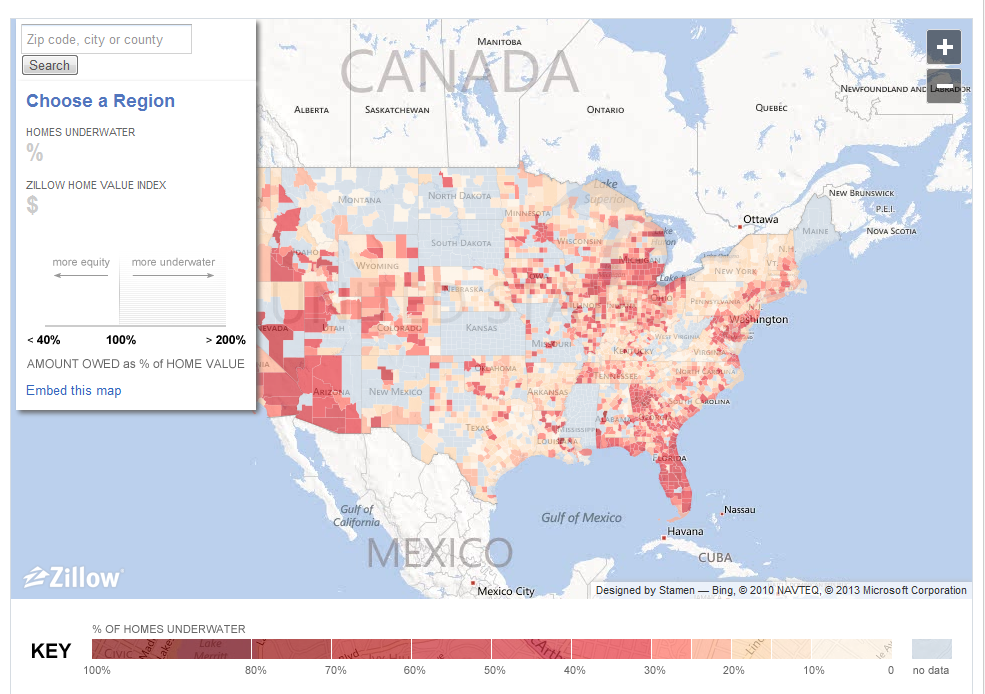

Underwater mortgages and low-ball prices of distressed properties froze home sales after the housing bubble burst; sales of existing homes in mid-2010 bottomed out at the annualized rate of 3.4 million a year. That’s changing: Sales as of October were up to 4.8 million a year, reports the National Association of Realtors, which forecasts 5.1 million sales in 2013.

Driving the sales, along with low mortgage rates, are rising prices.

Related: 10 great foreclosure deals

Longtime owners who were reluctant to match fire-sale foreclosure deals have been lured off the sidelines. And fewer shorter-term owners are stuck where they live, owing more on their mortgages than their homes are worth. Data firm CoreLogic says 1.3 million homeowners exited underwater territory as of June, and another 5% price increase would lift 2 million more borrowers above the waterline.

The picks: Roughly half of all self-storage transactions are tied to relocations, according to the National Self-Storage Association. CubeSmart (CUBE) is one of the best values in the sector, says Magiera of Manning & Napier. It trades at a lower P/E than larger rivals and has better prospects as it swaps out facilities in low-growth areas for regions with more potential. A recent dividend hike boosted the REIT’s yield to 3.2%.

A fresh coat of paint is a top item on the to-do list both for sellers preparing to list their homes and for recent buyers. Year-over-year growth in paint sales at Sherwin-Williams (SHW, Fortune 500) in the first half of 2012 was the highest since 2005, and the company’s cost of raw materials is falling. The stock, a top holding of veteran real estate manager Ken Heebner of CGM Funds, trades at a 30% discount to the S&P 500 when weighing its P/E against its projected earnings growth.

As home sales pick up, another demographic trend comes into play: the aging of America. Fourteen percent of buyers over 50 bought senior housing in 2012, says the NAR, up from 10% in 2010. And the pool of potential buyers — purchasers’ median age is currently 64 — is expanding: The 65-and-older population will rise from 40 million in 2010 to 72 million in 2030.

Two standout senior housing companies, says the Baron Fund’s Kolitch, are Brookdale Senior Living (BKD), which owns 565 properties in 35 states, and Emeritus (ESC), which focuses on assisted living and Alzheimer’s services. The firms, which are top holdings in his fund, trade for what Kolitch estimates to be 30% less than their private-market value — a wide discount compared to the REITs they resemble.

Or you could simply buy Baron Real Estate (BREFX) itself, which is 18% invested in senior housing and 30% overall in housing-related stocks (much of the rest of its holdings are in hotels and gaming stocks). Manager Kolitch joined Baron Funds as a real estate analyst in 2005; the fund has topped its category in two of the three years since its January 2010 launch.

The picks

You can ride the housing cycle with these stocks, mutual funds, and ETFs.

|

|

|

| Stock (Ticker) |

P/E |

Earnings growth (%) |

| Weyerhaeuser (WY) |

30.1 |

N.A. |

| Lowe’s (LOW) |

20.2 |

17.3 |

| CubeSmart (CUBE) |

19.6 |

9.4 |

| Sherwin-Williams (SHW) |

19.0 |

13.0 |

| Brookdale Senior Living (BKD) |

10.3 |

11.5 |

| Emeritus (ESC) |

10.8 |

14.5 |

| Fund (Ticker) |

Total return (1 year %) |

Total return (3 years %) |

| S&P Global Timber & Forestry ETF (WOOD) |

20.7 |

6.5 |

| S&P Homebuilders ETF (XHB) |

50.7 |

22.8 |

| Baron Real Estate (BREFX) |

39.6 |

N.A. |

NOTES: P/E ratios for stocks are based on projected 2013 profit. For CubeSmart, Brookdale, and Emeritus, P/E is price/projected funds from operations, used to measure real estate firms. Earnings growth is annualized three-to five-year projected rate; estimate is not available for Weyerhaeuser. Three-year-return figures are annualized. SOURCES: Bloomberg, Morningstar

First Published: February 14, 2013: 5:53 AM ET

Wildfires in the West, flooding and landslides in Alaska and hard-hitting Superstorm Sandy were just a few of the major natural disasters that hit the United States last year. In all, 112 federal disaster declarations were issued in 2012.

Wildfires in the West, flooding and landslides in Alaska and hard-hitting Superstorm Sandy were just a few of the major natural disasters that hit the United States last year. In all, 112 federal disaster declarations were issued in 2012.