2 Million Homeowners Freed From Negative Equity in 2012; 1 Million More to Come in 2013

Date:February 20, 2013|Category:Market Trends|Author:Cory Hopkins

Almost 2 million American homeowners were freed from negative equity in 2012, and the overall percentage of all homeowners with a mortgage in negative equity fell to 27.5 percent at the end of the fourth quarter, according to Zillow’s fourth quarter Negative Equity Report.

The falling negative equity rate is good news for struggling homeowners and is largely attributable to a 5.9 percent bump in home values nationwide last year to a median Zillow Home Value Index of $157,400 (when home values rise, negative equity falls). At the end of 2011, 31.1 percent of homeowners with a mortgage were underwater, or more than 15.7 million people.

In the fourth quarter, Zillow determined where American homeowners freed from negative equity in 2012 were located. Among the nation’s 30 largest metro areas, those with the highest number of homeowners freed from negative equity last year were Phoenix (135,099 homeowners freed in 2012); Los Angeles (72,936 homeowners freed in 2012); Miami-Fort Lauderdale (70,484 homeowners freed in 2012); Dallas-Fort Worth (59,461 homeowners freed in 2012); and Riverside, CA (58,417 homeowners freed in 2012).

Still, despite more than 1.9 million homeowners nationwide finding their way back above water last year, 13.8 million American homeowners are still struggling with negative equity. Many remain so far underwater that even the very high rates of appreciation experienced in many markets still can only bring them so far. In the Phoenix metro, for example, despite more than 135,000 freed homeowners last year, more than 300,000 homeowners — or 40.4 percent of homeowners with a mortgage — remain trapped in negative equity. This is largely attributable to the fact that although home values in Phoenix rose 22.5 percent last year, they remain more than 44 percent below their peak. So for those who bought at the peak, even with rapid appreciation, they still have a long way to go.

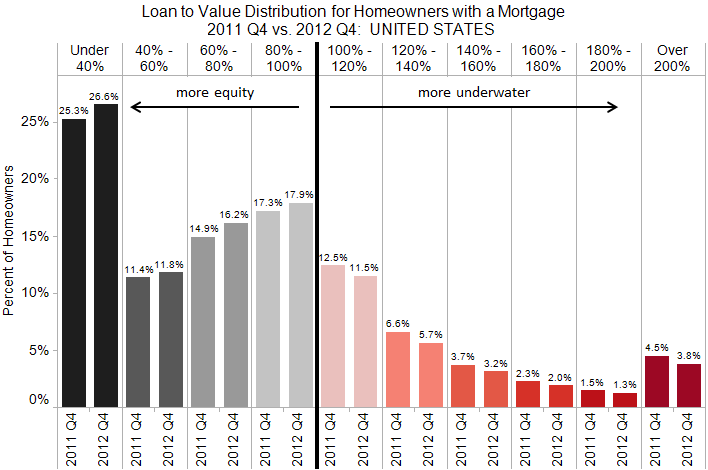

The graph below shows the loan-to-value (LTV) distribution for homeowners with a mortgage nationwide in 2012 Q4 vs. 2011 Q4. You can see that even though many homeowners are still underwater and haven’t crossed the bold 100 percent LTV line into positive equity, they are moving in the right direction. The 2012 Q4 buckets on the 100 percent+ LTV side (the red bars) are getting smaller compared to 2011 Q4, and the black bars are getting larger.

U.S. homeowners with a mortgage are slowly gaining equity back in their homes.

We also wanted to know how many more homeowners would be freed in 2013 and where they would be located. New this quarter, the Zillow Negative Equity Forecast predicts the negative equity rate among all homeowners with a mortgage will fall to at least 25.5 percent by the fourth quarter of 2013, freeing more than 999,000 additional homeowners nationwide. Of the 30 largest metro areas, the majority of these newly freed homeowners are anticipated to come from Los Angeles (72,696 homeowners freed in 2013); Riverside (62,407 homeowners freed in 2013); Phoenix (43,044 homeowners freed in 2013); Sacramento (33,356 homeowners freed in 2013); and Dallas-Fort Worth (31,434 homeowners freed in 2013).

Zillow forecasts negative equity by applying anticipated appreciation or depreciation rates to a home, according to the most current metro and national Zillow Home Value Forecasts, and by assuming all other factors remain constant.

“As home values continue to rise and more homeowners are pulled out of negative equity in 2013, the positive effects on the housing market will be numerous. Freed from negative equity, homeowners will have more flexibility, and some will likely choose to list their home for sale, helping to ease inventory constraints and moderating sometimes dramatic, demand-driven price increases in some markets,” said Zillow Chief Economist Dr. Stan Humphries. “But negative equity is still very high, and millions of homeowners have a very long way to go to get back above water, even with current robust levels of home value appreciation in most areas. As a result, negative equity will remain a major factor in the market for the foreseeable future.”

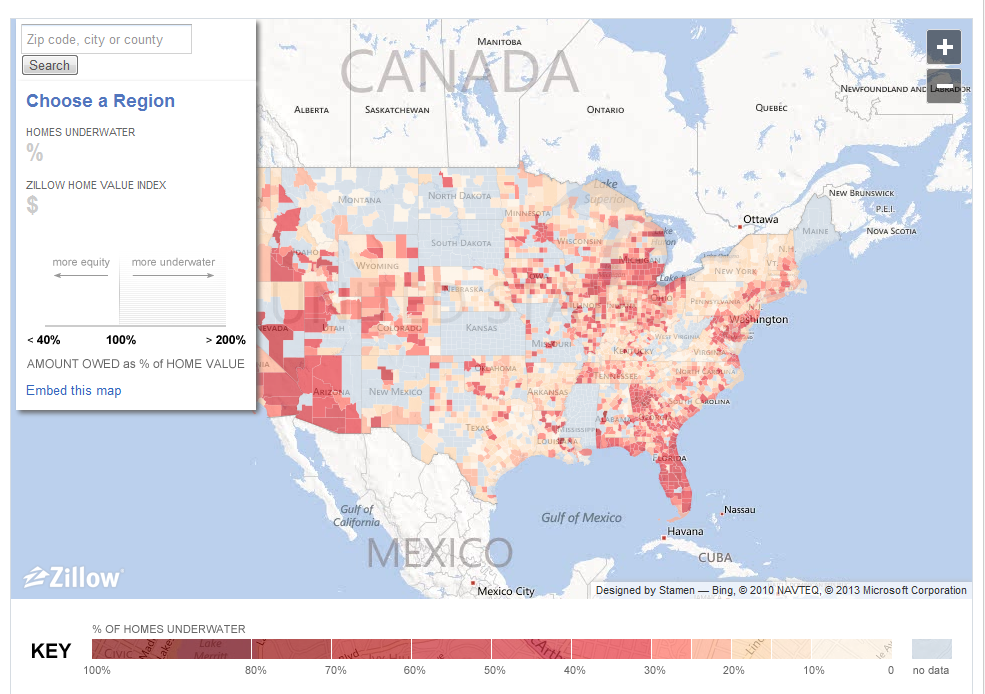

Also, new this quarter, users can zoom in on a portion of our Negative Equity visual and embed only that portion on their website. So, for example, if you were in Seattle and wanted to post the interactive tool to your site, we would be happy to show you how.